Molecular testing has become an economic powerhouse for the lab industry and contributes a wealth of valuable information to patient care. But even as researchers and labs look for the latest breakthroughs, the government and other payers are still trying to make up their minds about what these tests are worth and how to keep track of them. This month, the Centers for Medicare and Medicaid Services (CMS) implements a completely new system for coding molecular tests on Medicare claims. For more than a year, the lab community waited in limbo while physician organizations tried to persuade CMS to move the new Common Procedural Terminology (CPT) codes to the physician fee schedule—a change that non-pathologist laboratorians worried would undercut their long-standing professional role overseeing molecular tests.

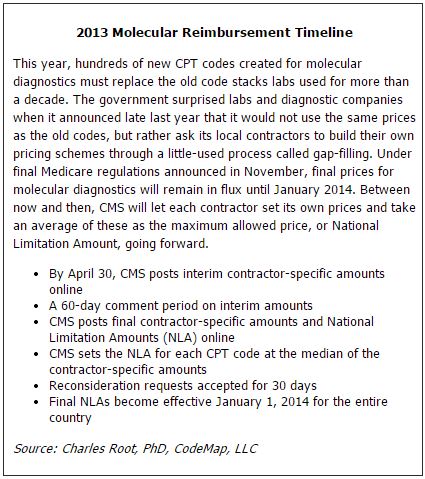

In November, CMS finally decided it would keep the new codes on the clinical lab fee schedule as planned. However, the agency now has replaced last year's worry for labs with a new one: how will these tests be paid? Rather than carry over the payment associated with the old set of codes labs are accustomed to, CMS asked its local administrative contractors to come up with their own payment schemes from scratch. This so-called gap-filling method has never before been used for such a large swath of the lab fee schedule, and is creating even more uncertainty over the fate of molecular testing.

According to lab coding expert Charles Root, PhD, Medicare contractors have their work cut out for them as they come up with payment for the new codes, as most have little expertise in molecular diagnostics. "Ultimately, the only way labs will really know what they will be paid in January will be to submit a claim to Medicare and see what comes back," he said. The founder and president of CodeMap, LLC, Root spoke as part of AACC's Reimbursement and Regulatory Update webinar on November 27.

Flying in the Dark

Overall, the shift to the new coding system looks like an improvement to labs and diagnostic companies, but the devil is in the details, emphasized industry consultant Rina Wolf. "This should be good news. But the whole pricing issue is absolutely key, because we're totally flying in the dark right now," she said. "We don't know what this is going to mean from any of the payers, whether from CMS or the commercial payers, who usually follow the lead of CMS." Wolf is vice president of commercialization strategies, consulting, and industry affairs at XIFIN, a revenue cycle management solutions company.

At CLN press time in mid December, CMS had yet to offer any instructions to its contractors on how they should go about paying claims with such a short window to gap-fill their pricing. Wolf urged CMS to take a balanced approach that would allow contractors to make informed decisions. "I think it's very important for CMS to balance our need to get the answers on pricing with the ability to get the job done in a considered and appropriate way," she said. "This is one of the biggest issues facing the business of clinical laboratories right now, and the business of the lab directly affects patient care. Some diagnostic companies run on such incredibly slim margins that this will have a huge impact on their ability to survive."

Some contractors have almost nothing to go on for pricing the new codes, due to the way the previous system of stacking multiple codes for each test obscured what was being paid for. "With the old way of using code stacks, some of these contractors probably weren't even aware that they were seeing claims for certain tests," Wolf said (See Box, below).

New Molecular Codes Take Effect for 2013

Despite uncertainties about how they will be reimbursed, the new molecular codes that come into full effect this year solve some long-standing problems. Without unique, analyte-specific codes for molecular tests, labs have for decades cobbled together their own lists of other codes that describe the various steps of performing the test. For labs, this led to headaches with denied claims or underpayment. For payers, it meant they never really knew which tests they were paying for or what the tests really cost, since all they could track were the fragments of each lab’s unique bundle of codes, rather than the whole.

Perhaps just as significant, claims data have been almost worthless for tracking physicians’ utilization of these advanced tests. A white paper from UnitedHealthcare’s Center for Health Reform and Modernization noted as an example that under the old coding system, the genetic test for Canavan disease required six steps and thus six procedure codes. However, labs also used these same procedure codes for genetic tests for five other diseases, including cystic fibrosis and Tay-Sachs, leaving the payer unable to distinguish one test from the other.

In 2011, the American Medical Association (AMA) released its overhauled coding system for molecular tests with a new tiered approach that featured analyte-specific codes. The Centers for Medicare and Medicaid Services (CMS) essentially outsources this work to AMA, but in this case could not decide how to implement AMA’s work. AMA, as well as the College of American Pathologists (CAP), pushed CMS to make molecular coding and reimbursement a pathologist-centered rather than a lab-centered system, arguing that molecular tests require a pathologist’s interpretation and should reside on the physician fee schedule.

Diagnostic companies and many others in the lab community welcomed the news late in 2012 that CMS would keep the new codes on the lab fee schedule for 2013, according to Rina Wolf, vice president of commercialization strategies, consulting, and industry affairs at XIFIN, a revenue cycle management solutions company. “We believe that this is good news because our contention has been that these are not new tests, these are new codes for existing tests for which the components all previously were on the clinical lab fee schedule,” she said. “We also believe that the majority of these tests do not require additional pathology interpretation. CMS did acknowledge that, and provided a temporary code, G0452, for those circumstances where an ordering physician believes that it is appropriate to have an additional pathology interpretation.”

Under the new coding system, tests that make up the majority of the volume of molecular diagnostics fall into the first tier of a two-tier system. Tier 1 is home to some 100 codes that together represent more than 90% of the volume of molecular tests currently performed. Tier 2 is reserved for low-volume, esoteric tests, within which are nine buckets based on test complexity. A different CPT code is reserved for each of the nine levels. Within each level, many different tests can reside. Notably, it is up to AMA to list which particular tests can be coded under each level—labs cannot self-assign. Labs have to be sure that AMA has listed the particular test they use under one of these codes in order to bill Medicare.

Even the contractor with unquestionably the most experience in molecular diagnostics, Palmetto GBA, would have a lot of work to do before rolling out a new pricing scheme, explained Elaine Jeter, MD, the medical director of Palmetto's Molecular Diagnostics Services Program (MolDX). "The time is short and a lot of information is required," she said. "We don't have any information on the resources required for an assay, only what the labs have been billing." Palmetto's MolDX program covers Medicare claims in California, Nevada, and Hawaii.

One reason that experts worry about CMS's choice of gap-filling is that CMS has employed this method infrequently and imperfectly. In most cases, CMS prices new codes by borrowing prices from existing, similar codes in a centralized fashion. This simpler, kinder method is called crosswalking.

"There are usually 10 to 20 new lab codes every year, and CMS has in the past only used gap-fill for a test about once every 4 years, so it's been very exceptional for any test to go through the gap-fill process," said Bruce Quinn, MD, PhD, senior health policy specialist at Foley Hoag, LLP. "The only one in my nine years of experience with Medicare was for HbA1c measured directly in the office, and that was very messy. A lot of contractors were uncertain about how to price it, and local prices varied almost by a factor of three. Finally, Congress stepped in and decided what the payment would be, effectively canceling the gap-fill process."

Private payers are in a jam, too. They depend on Medicare's published price list, which no one expects for some time. And even when CMS does give contractors parameters to begin gap-filling, commercial payers will still have to sort out which contractor they will follow if prices vary across the country, Wolf noted. "This is of tremendous concern to diagnostic companies. Of course, the industry wants to provide the best patient care, but these are also businesses that have to survive so that they can do that. With no clarity on pricing, they can do no revenue modeling for 2013—they don't even know if they'll be able to afford to do these tests anymore."

According to Root, gap-filling allows contractors to use four methods to calculate pricing: what is charged for each test; the resources and actual costs of performing the test; payment amounts determined by other payers; and the payment amounts or resources required for comparable tests. CMS may give contractors some direction on which of these methods they should use. However, because the previous coding system concealed what contractors were paying for, it seems likely the first two options would be very difficult. "My own opinion is that most contractors will be looking to see what Palmetto does," Root said. "They will be the leader here and should have the most data on what they're actually paying for right now." In either case, CMS will not even publicly post interim contract-specific amounts until April (See Box, below).

Palmetto Takes Center Stage

As Medicare's contractors try to make sense of how to price the new molecular codes, all eyes will be on Palmetto GBA, the first and only contractor to develop its own program specifically to address the burgeoning field of molecular diagnostics. Palmetto's MolDX program requires each test to carry a unique identifier. This way, Palmetto can keep track of which tests it pays for and how they are used. With the new ability to recognize these tests for what they are, MolDX also requires a technology assessment before deciding on whether it should be covered under Medicare as "reasonable and necessary." The technology assessment looks at analytical and clinical validity as well as clinical utility.

Since Palmetto is the only entity in Medicare that appears to have a grasp of molecular testing, some experts believe that the best route for CMS would be to adopt MolDX as a national program. According to Mike Barlow, vice president of Palmetto's Jurisdiction 1 operations under which MolDX operates, such a move would be easier said than done. "We've had discussions with CMS about this since we have a very successful program with demonstrated results," Barlow said. "At the same time, CMS has limited options on this within the regulations."

Not to be confused with the new CPT codes, MolDX unique identifiers go a step further in that they differentiate between different companies' FDA-approved tests or different labs' laboratory-developed tests (LDTs). The new CPT codes, developed by the American Medical Association (AMA), are analyte-specific, so they're blind to methodology—and to a lab or company's particular assay.

Although the old code stacking system created problems for both payers and labs, molecular tests under the new codes will still require unique identifiers and technology assessments under MolDX, Jeter noted. "Code stacking was worse, but there are still gaps," she said. "Without the unique identifiers, we still don't know what we're paying for." For example, Jeter noted that for BRAF gene testing, three FDA-cleared tests exist, and at least 25 LDTs. Under the old system, each FDA-cleared test and most of the LDTs billed Medicare with unique code stacks. Although the new molecular CPT codes will fix that problem, they still don't differentiate among the 30 or more assays for BRAF, as they'd all share the same analyte-specific code.

On the other hand, just because AMA has assigned a new CPT code to a test does not mean MolDX will automatically cover it, Jeter emphasized. Certain esoteric, low-volume tests will reside on a second tier of CPT codes under the AMA system that are not analyte-specific and coded by level of complexity, offering even less transparency. "ApoE is an assay in Tier 2, Level 2. Since this assay has no proven clinical utility, how will other payers separate this non-covered assay from others in Tier 2, Level 2 that warrant coverage?" Jeter said. "With unique identifiers, Palmetto GBA is able to create edits to deny coverage for ApoE, yet appropriately pay for other assays in Tier 2, Level 2."

Even if CMS chooses not to adopt Palmetto's MolDX program nationally for Medicare, private payers are eager to capitalize on MolDX's work. According to Wolf, several payers have approached Palmetto requesting access to their database of unique test identifier codes. "It's the opinion of many of us in the diagnostics industry that this could be a good thing," Wolf said.

Multi-analyte Algorithmic Tests in Limbo

In rolling out the new molecular codes, AMA also created codes for a new breed of tests that use multiple analytes and an algorithm to produce a result, such as a risk score. In some cases, the algorithms are proprietary. Laboratorians might be familiar with the Food and Drug Administration (FDA) term for these tests, In Vitro Diagnostic Multivariate Index Assays (IVDMIA). AMA's term, adopted by CMS, is Multi-analyte Assays with Algorithmic Analysis (MAAA).

For now, CMS will not pay for these tests and their codes will not appear on Medicare fee schedules. According to CMS, "Medicare does not recognize a calculated or algorithmically derived rate or result as a clinical laboratory test since the calculated or algorithmically derived rate or result alone does not indicate the presence or absence of a substance or organism in the body." CMS prefers to pay only for the individual component tests that feed into the algorithm, but not the MAAA as a whole.

According to Root, when CMS doesn't recognize codes, commercial payers usually will not either, making reimbursement that captures the full value of MAAAs highly uncertain. "CMS is sustaining its policy that algorithms are simply arithmetic, no matter how sophisticated, and have no value in reimbursement," he said. "Obviously, this is contrary to fact in some cases, because some algorithms have cost millions of dollars to develop and may be extremely expensive. And they will probably be licensed as well—that's the only way the developers will get any money back—so a laboratory that licenses the use of a multi-analyte panel will not get Medicare payment for that use of the algorithm."

More Pain for Pathology Labs

If pathologists saw CMS's decision to put the new molecular codes on the clinical lab fee schedule as a loss, they should prepare for even greater worries ahead when it comes to reimbursement for traditional anatomic pathology services. Depending on how often a pathology lab performs certain procedures, a cut this year to a single code—88305—could have a big impact. Pathology labs frequently use this code to bill for preparing slides, representing about $1.5 billion a year for Medicare.

The 2013 physician fee schedule slashes payment for the lab work involved in this code by 51%. As with many pathology codes, the code is used for both the pathologist's interpretation as well as the labor of other lab professionals and supplies needed to prepare the slide. For 2013, the lab portion of this payment is $33.70, down from $69.78 in 2012, according to Root.

Even though CMS increased the payment slightly for the professional interpretation element of this code, it could have a big impact on certain labs, depending on what constitutes the core of their business, explained Quinn. "The affect of this cut will be somewhat selective. If you were running a shop that performed thousands of skin biopsies and prostate biopsies, then it would be a huge impact. But if that code only represented two percent of your business, it might not matter much."

A Waiting Game

According to experts, labs are limited in how they can plan for reimbursement changes coming with the new codes. Labs must use the new CPT codes and make sure the old codes are deactivated in their billing systems, Root noted. As CMS and local Medicare contractors negotiate a way through the gap-fill process, labs should keep in close contact with their own contractor and make sure they receive e-mail and other updates.

For more about how budget negotiations in Congress will affect labs, see a special article by AACC government affairs director, Vince Stein, PhD.