The 2012 presidential election is history, and the White House and Congress are back at work in Washington, D.C. By winning, President Barack Obama became the third incumbent President in a row to be re-elected and the fifth Chief Executive to do so since 1972. Similarly, voters returned a Democratic Senate and Republican House of Representatives, allowing Senator Harry Reid (D-Nev.) and Representative John Boehner (R-Ohio) to keep their respective leadership positions. Now as the new year begins, the two sides need to put aside the bitterness of the past year and work together to resolve a number of pressing issues facing the nation, particularly budgetary matters, that are likely to impact healthcare spending and clinical laboratories.

Falling into the Abyss?

At CLN press time in December, all of Washington was talking about the pending 'fiscal cliff.' This term, first coined by Federal Reserve Chairman Ben Bernanke, reflects his concerns about the impact of $700 billion in spending cuts and tax increases scheduled to take effect on January 1, 2013. The immensity of these budgetary changes could, according to the Congressional Budget Office (CBO), result in the "economy toppling back into recession." This concern about the state of the economy has lawmakers scrambling to work out deals to develop a long-term deficit reduction package and enact legislation to retain most of the Bush-era tax cuts.

The current crisis is a byproduct of the Budget Control Act of 2011 that Congress passed to forestall an earlier budgetary shortfall. This legislation required $1.2 trillion in across-the-board spending cuts over 10 years starting in 2013 and split evenly between domestic and defense spending. Although certain programs such as Medicaid, Social Security, and Veterans benefits were exempted from these reductions, Medicare was not. The law did allow Congress to replace the indiscriminate cuts with more targeted reductions prior to the effective date. Until now, Congress has been unable to do so.

Another element of the fiscal cliff is the Bush-era tax cuts that are set to expire at the end of 2012. President Obama has proposed extending these tax benefits to families making $250,000 annually or less. According to the Citizens for Tax Justice, this limited extension would reduce federal revenues by $243 billion in 2013 and more in the following years. Congress is likely to pass some variation of the President's offer, and this means the legislative branch will need to find additional revenues to pay for extending the tax cuts.

Legislators are looking for ways to save money to pay for potential tax cuts and healthcare reform in 2013. Laboratory professionals should pay close attention to the issues and be proactive with their legislators. AACC's Government Affairs Advocacy Network allows you to contact your elected officials and regulators to express your opinion on a variety of legislative and regulatory issues important to clinical laboratorians. More information is available online.

Payment Reductions for Labs Looming

Also looming as part of this fiscal nightmare is a projected 26.5% cut in Medicare physician payments. Past congressional efforts to restrict the growth in physician reimbursement created what many consider a formula that specifies annual deep reductions in physician payments. Now, every year Congress has to intervene to prevent these cuts. Legislators passed a $17 billion fix in 2012 that included a number of cuts to healthcare providers, including a 2% cut in the clinical laboratory fee schedule beginning in 2012. Another temporary fix in 2013 is expected to cost $25 billion, so legislators will have to find money to pay for this budgetary issue as well.

Physicians aren't the only ones facing pay cuts. Payment reductions in 2013 are coming for labs too as a result of the 2010 healthcare reform law. The reform package included two annual cuts for clinical laboratories: a permanent reduction in the clinical laboratory consumer price index (CPI) update by a "productivity adjustment" and a 5-year annual cut in the CPI update of 1.75% that expires in 2015. These cuts, combined with physician fix reductions, will cut laboratory payments by 2.95% in 2013. But this figure could increase to 4.95% if Congress fails to address the fiscal cliff and the across-the-board Medicare cuts take effect on January 1st as a down payment for deficit reduction.

More on the Table

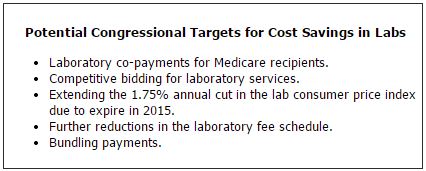

Given the scope of the U.S. budgetary issues, Congress has even been discussing such sacred cows as reducing the mortgage interest and charitable tax deductions. In other words, everything is on the table, and it's likely that clinical laboratories will be a target to contribute more. Lawmakers have a laundry list of potential items to choose from that will hurt laboratory budgets (See Box).

In the short-term, Congress may agree to a 6-month delay to work out a long-term deal with the White House given the sensitivity and politics surrounding the issues. However, the window of opportunity is small because legislators will soon start thinking about the 2014 mid-term elections.

Healthcare Reform Resurfaces

Another issue that will receive a lot of attention in 2013 will be healthcare reform. With the election over and Republicans conceding they are unable to repeal the law, policymakers will focus their attention on implementation of the act. Some of the more popular and easier to implement provisions of the law are already in effect, such as allowing children up to age 26 to remain on their parents' insurance, barring the denial of insurance coverage to individuals under 19 due to pre-existing conditions, and expanding prevention and wellness benefits. Over the next 2 years, however, some of the more complicated, costly, and controversial provisions will go into effect.

One difficult provision involves implementing state insurance exchanges. These local entities will be responsible for reviewing and approving qualified health plans, educating consumers and small businesses, and enrolling participants in the plans. To date, 17 states and the District of Columbia have agreed to create and manage such exchanges; however, nearly 20 states have declined to participate and the rest are undecided or partnering with the federal government. If a state chooses not to create an exchange, the Department of Health and Human Services (HHS) is required to develop and oversee it. At this point, it's unclear whether HHS can get these exchanges up and running by the fall of 2013 so potential enrollees can select a plan.

Of importance to clinical laboratories is that each participating insurance plan must cover certain "essential health benefits" as prescribed by the act. Included among the 10 required services is laboratory testing. The good news for laboratories is that implementing this provision should result in an increase in the volume of laboratory services ordered. CBO estimates that nearly 12 million people will obtain coverage through the exchanges in 2014, a number that is expected to increase to 27 million by 2018.

Another feature of the healthcare reform law makes parents, children, and childless couples with family incomes below 133% of the federal poverty level eligible for Medicaid. More than half of the 30 million newly insured will receive coverage through the federal-state poverty program. This expanded coverage, in addition to increasing volume, may reduce the level of uncompensated care borne by healthcare providers, as well as increase the volume of testing for clinical laboratories. However, as with the exchanges, there are complications.

Last summer, the Supreme Court ruled that states do not have to expand their Medicaid programs as specified in the healthcare law to continue participation in the program. Many states argue that Medicaid is already costly and that they cannot afford the expansion prescribed in the law. Currently, more than a dozen states, including Texas and Florida, which have large uninsured populations, have stated they will not participate in the Medicaid expansion. If these states maintain their opposition to this policy change, the benefits derived from healthcare reform, at least in the short-term, will be less than expected.

Stay Informed and Prepare to Take Action

Over the next 12 months, laboratory professionals will need to remain actively engaged in policy debates involving the federal budget and healthcare reform. Each of these issues could significantly affect laboratory operations in the short and long term as lawmakers seek to pull the U.S. back from the fiscal cliff and implement the most far-reaching federal health legislation since the passage of Medicare and Medicaid in 1965.

AACC and CLN will continue to keep you abreast of these issues as decisions are made and announce opportunities for you to influence policy.

Vince Stine, PhD, is director of government affairs at AACC.

Email: [email protected]